The RBI maintains the 6.5% benchmark lending rate for the eighth consecutive month.

The Reserve Bank of India has chosen to maintain the repo rate at 6.5% for the 2024–25 fiscal year.

The Reserve Bank of India (RBI) has chosen to maintain the 6.5% key repo rate as it continues to prioritize the "withdrawal of accommodation."

The six-member Monetary Policy Committee (MPC) of the central bank has opted to maintain the key policy rates at their current levels for the eighth consecutive meeting.

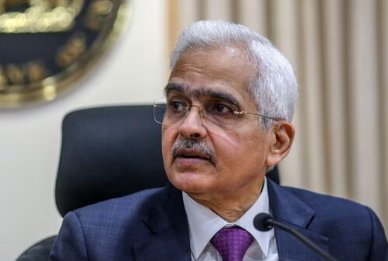

The real GDP growth estimate for the fiscal year 2024–2025 has been revised upward from the prior estimate of 7% to 7.2% by RBI Governor Shaktikanta Das.

As of right now, we are expecting 7.2% GDP growth for the current fiscal year 2024–2025, with 7.3% growth in Q1, 7.2% growth in Q2, 7.3% increase in Q3, and 7.2% growth in Q4. "There is a balance between the risks," stated RBI Governor Shaktikanta Das.

The Reserve Bank of India (RBI) intends to keep concentrating on ending its policy of accomodation. A typical south-west monsoon is also predicted, which should increase the output of kharif crops and raise reservoir water storage levels.

The 4.5% inflation estimate for FY25 is maintained by the RBI. Shaktikanta Das reaffirmed the RBI's commitment to eventually bringing inflation down to the 4% target.

What's Your Reaction?